By Leika Kihara and Takahiko Wada

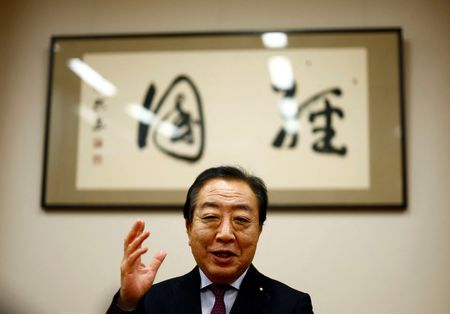

TOKYO (Reuters) -The Bank of Japan must raise interest rates and continue phasing out its controversial stimulus programme, Yoshihiko Noda, leader of Japan’s biggest opposition party, told Reuters on Friday.

He also said Japan needs to focus more on getting its fiscal house in order by ending big, crisis-mode spending and finding ways to boost tax revenues, such as raising the capital gains tax rate.

Noda’s Constitutional Democratic Party of Japan is expected to wield significant clout since its major victory in a general election on Oct. 27 – though it remained short of a majority.

Noda, who served as prime minister from 2011 to 2012, criticised former BOJ Governor Haruhiko Kuroda’s decade-long, radical stimulus programme – deployed in 2013 – for side effects such as excessive yen weakness.

The weak yen has caused more harm than good to Japan’s economy by pushing up import costs and hurting households, said Noda.

“It is wrong to focus too much on keeping monetary policy ultra-loose when Japan is experiencing inflation,” he said.

“The BOJ should raise interest rates gradually without committing to hike at a set pace,” Noda said, adding the central bank should hike cautiously with a close eye on economic and overseas developments.

Under incumbent Governor Kazuo Ueda, the BOJ exited Kuroda’s radical stimulus in March and raised short-term interest rates to 0.25% in July on the view Japan was progressing towards durably achieving its 2% inflation target.

Prime Minister Shigeru Ishiba’s administration plans to spend 13.9 trillion yen ($92.62 billion) for a package of steps to cushion the blow from rising living costs.

Ishiba’s ruling coalition is also seen swallowing opposition party demands for permanent tax breaks, which analysts say may slash next year’s tax revenues by up to 4 trillion yen.

Such steps would come in the wake of the BOJ’s exit from ultra-low interest rates, which increases the cost of funding Japan’s 1,100-trillion-yen debt pile – the biggest among advanced nations and nearly double the size of its economy.

($1 = 150.0700 yen)

(Reporting by Leika Kihara and Takahiko Wada; Editing by Saad Sayeed)