By Bharath Rajeswaran

(Reuters) -Indian shares fell on Saturday, led by infrastructure-related stocks after the government only modestly raised its capital expenditure budget, although the losses were limited by a jump in consumption-linked sectors after a cut to income tax.

The Nifty 50 was down 0.27% at 23,447.65 points as of 1:28 p.m. IST in a special trading session, while the BSE Sensex had shed 0.14% to 77,372.74.

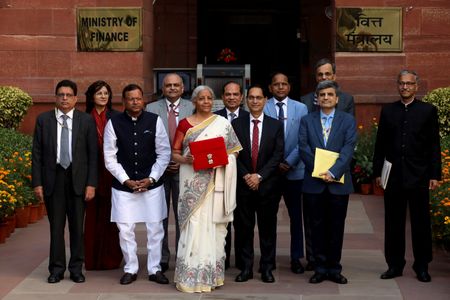

Finance Minister Nirmala Sitharaman, in the annual budget, set India’s capex outlay at 11.2 trillion rupees (about $130 billion) for 2025-26, a modest increase from 2024-25, which Sandeep Nayak, CEO of retail broking at Centrum Broking, said is a “mild negative.”

That put pressure on industrial and infrastructure firms. Larsen & Toubro (L&T), PNC Infra and NBCC dropped about 4% each, with L&T the top Nifty loser.

“The budget fell short on government allocation, which has led to a drop in capital goods, engineering and infrastructure companies, weighing on markets,” Gaurav Dua, senior vice president, head of capital markets strategy at Mirae Asset Sharekhan.

Sitharaman, though, also unveiled plans to cut income taxes, a relief for a country struggling with slowing consumption.

Consumption-linked sectors such as fast-moving consumer goods rose 4.4%, while auto and realty gained 2.1% and 2.2%.

Trent, Maruti Suzuki, Britannia, Hindustan Unilever and Tata Consumer were the top boosts to the Nifty 50.

“With the economy in a slowdown and considering the low consumption demand, the tax relief by the government is a big relief and would boost demand and consumption,” said Divam Sharma, co-founder and fund manager at Green Portfolio.

Ten of the 13 major sectors declined, while the more domestically focussed mid-cap and small-cap indexes shed about 0.6% and 0.9%, respectively.

Sharekhan’s Dua, however, said the budget was broadly in line with expectations, giving the markets leeway to take a pause after gaining about 3% in the four sessions leading up to the budget.

Among other stocks, pipe makers gained as the government extended a scheme to enhance water supply until 2028.

Fertiliser companies advanced after the government announced a further increase in urea supply.

Footwear makers rose on policy plans to support the leather industry, while tourism-linked companies gained on plans to develop top destinations with key infrastructure.

(Reporting by Bharath Rajeswaran in Bengaluru; Editing by Savio D’Souza, Eileen Soreng and Sonia Cheema)