By Samuel Indyk and Lucy Raitano

LONDON (Reuters) – European stocks have hit record highs this month, as companies have beat fourth-quarter revenue expectations, but the topic that dominates the conversation among executives in the region is U.S. tariffs.

According to LSEG I/B/E/S, fourth-quarter earnings are expected to have increased 5.4% from the same period a year ago, while sales are forecast to have risen 4.7%, the highest quarterly growth rate since Q4 of 2022.

Bank earnings remained strong and luxury stocks have shown signs that sales are starting to recover from a slump, but companies remain on edge about U.S. President Donald Trump’s protectionist measures that threaten to disrupt global trade, not least as Europe is a potential target.

Here are five lessons from earnings so far:

TARIFFS ON MY MIND

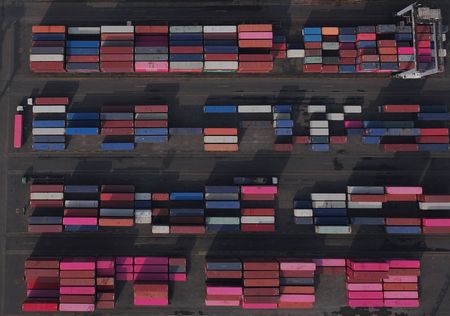

While sales beats have been strong, companies are gearing up for heightened uncertainty and an economic hit from U.S. import tariffs as Trump attempts to rewrite the rules of global trade.

Analysis by market intelligence platform AlphaSense showed 128 mentions of the words “tariff” or “tariffs” in STOXX 600 earnings transcripts since the start of the year, a more than 70% increase in the last 90 days.

“Companies are right to be cautious,” said Frédérique Carrier, head of investment strategy at RBC Wealth Management.

“For European stocks, earnings risk may be mitigated by the fact that many companies have manufacturing facilities in the U.S.. The main exceptions are: German autos, spirits, and luxury, three sectors which will likely be more impacted than others.”

EARNINGS DAY VOLATILITY SOARS

An ongoing trend this reporting season is increased share price volatility on the day of results, with the size of upwards and downwards swings reaching near-record highs, according to data from Bank of America.

The data published on February 10 showed companies missing fourth-quarter expectations recorded a median one-day underperformance of 2.6%, the biggest since the bank’s records began in 2012.

Those beating on earnings per share recorded a median outperformance of 1.7%, the second strongest on record.

Bigger moves around earnings have prompted a growing number of typically cautious longer-term investors to seek to capitalise on price swings.

WEAK EURO = STRONG SALES

Around one-third of companies in the STOXX 600 have reported Q4 sales figures and almost three-quarters of them have beaten expectations, according to LSEG data, well above a typical quarter where 58% usually beat analyst revenue estimates.

That is the highest proportion of “beats” in over two years and analysts and companies have highlighted the weaker euro, which has fallen as much as 10% against the dollar since September, as a major factor.

“Top-line strength owing to the FX tailwinds has been the story of the season in Europe so far,” said Barclays European equity strategist Magesh Kumar Chandrasekaran.

LUXURY IS BACK

Even with the threat of tariffs, sales from the luxury sector – from high-end Hermes, to turnaround play Burberry – have broadly beaten expectations, leading to an upturn in fortunes for some lagging shares.

“Sentiment had become so depressed and analysts had become more cautious with their estimates,” said Josephine Cetti, chief investment strategist at Nordea.

“At some point, things turn around and that’s where we are now. When markets are negative and sentiment is low, it doesn’t take much to improve things in a positive direction.”

While sales in China, the traditional growth engine for the sector, remained subdued for most, surprising resilience in Europe and particularly the U.S. helped companies such as Richemont to beat expectations and push LVMH to become Europe’s largest company again.

BANKS PARTY LIKE ITS 1997

European banks have reported another sharp rise in profits in the fourth-quarter, helped by robust margins, even in the face of a sluggish economy and European Central Bank rate cuts.

The STOXX Europe 600 banks index is heading for its ninth straight positive week, its longest such streak since February 1997. The gains are not just sustained by high margins.

“They’re seeing decent top-line growth and keeping costs down and it’s just a much better environment when you have higher interest rates,” Nordea’s Cetti said.

“They do share buybacks, they increase their dividends, so we like financials,” she added.

(Reporting by Samuel Indyk and Lucy Raitano; editing by Barbara Lewis)