By Liz Lee

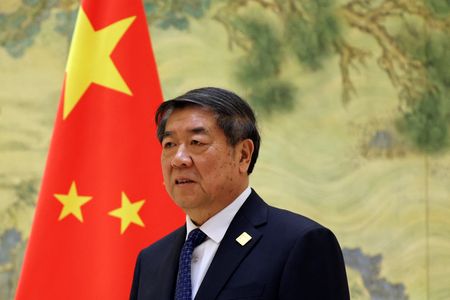

BEIJING (Reuters) -China’s economy tsar, Vice Premier He Lifeng, sought to reassure foreign CEOs of the country’s business potential, describing the economy as highly resilient, while global investment banks cautiously raised their 2025 outlook for the country.

Vice Premier He met with the heads of Apple, Pfizer, Mastercard, Cargill and others on Sunday, and held meetings with pharmaceutical firm Eli Lilly, medical device company Medtronic and specialty glass maker Corning, a commerce ministry statement said.

Beijing is keen to stabilise foreign investment and attract new capital as policymakers try to boost domestic consumption to offset the impact of U.S. tariffs on Chinese goods.

Several global investment banks have acknowledged China’s latest supportive policy moves, with Nomura, ANZ, Citi and Morgan Stanley all raising their forecasts for the country’s 2025 economic growth by 50 basis points since last week.

However, they all fell short of China’s official growth target of around 5%, citing U.S. tariffs and domestic deflationary pressures.

“China will continue to improve the business environment and welcome more investment by multinational companies in China, sharing opportunities for development,” He told the business leaders, describing China’s economy as “highly resilient” and “full of vitality”.

Foreign CEOs are attending the China Development Forum in Beijing on Sunday and Monday, with some expected to meet President Xi Jinping on Friday, sources have told Reuters.

Jean-Pascal Tricoire, the chairman of French electrical equipment maker Schneider Electric, said that it will continue to increase its investment in China.

The company is ready to work with Chinese partners to promote high-quality development of the industry, state-run Shanghai Securities News reported Tricoire as saying.

On Monday, Cargill CEO Brian Sikes also met China’s commerce minister.

“Broadly, the message of China’s government is that they are open for business and foreign direct investment despite disappointing numbers last year,” Bert Hofman, Professor at the East Asian Institute at the National University Singapore, told Reuters.

‘RISING INSTABILITY’

The Trump administration has imposed 20% tariffs on all Chinese goods since taking office in January, accusing Beijing of not doing enough to stem the flow of fentanyl into the United States.

Chinese Premier Li Qiang, speaking at the forum on Sunday, urged countries to open their markets to combat “rising instability and uncertainty”, and promised more active macroeconomic policies.

U.S. Republican Senator Steve Daines, a staunch supporter of President Donald Trump, met Li on Sunday with seven senior executives from U.S. companies. Daines called the meeting a chance for them to air their views on the business environment in China directly to Li.

Some 86 company representatives from 21 countries came to the business forum this year, with American firms making up the largest group of attendees, state broadcaster CCTV said.

However, a source said fewer American CEOs are in attendance compared with last year.

“Definitely, we have confidence for China’s development. We have been invested consistently for decades in China, and we will continue for decades to come,” Corning CEO Wendell Weeks told the state-run Global Times.

American direct-selling firm Amway was monitoring the impact of U.S. tariffs, but its chief executive, Michael Nelson, said the company is focused on the future of the Chinese market, according to the newspaper.

Apple, which depends heavily on China for the production and assembly of its products, on Monday announced that it will set up a new clean energy fund worth 720 million yuan ($99 million) to expand its clean energy capacity in China.

(Reporting by Liz Lee and Shanghai newsroom; Editing by Tom Hogue and Sonali Paul, Kirsten Donovan, William Maclean)