By Dominique Vidalon

PARIS (Reuters) -This year’s “Choose France” business summit hosted by President Emmanuel Macron is expected to secure 20 billion euros ($22.47 billion) of new investment, his office said on Monday, announcing projects in the defence, energy and industrial sectors.

Macron’s personal efforts to woo international business leaders, making the Choose France summits at the opulent Palace of Versailles a must-attend for the global corporate elite, have been credited for a turnaround in past investor perceptions of France as a high-tax, sclerotic economy.

Last year’s gathering raised 15 billion euros. An additional 17 billion euros worth of projects have already been pledged ahead of the start of 2025’s event later on Monday, Finance Minister Eric Lombard said on RTL radio.

U.S. logistics giant Prologis is set to invest 6.4 billion euros in four data centres in the Ile-de-France while London-based fintech Revolut plans to invest 1 billion euros over the next three years on expanding in France and will apply for a French banking licence.

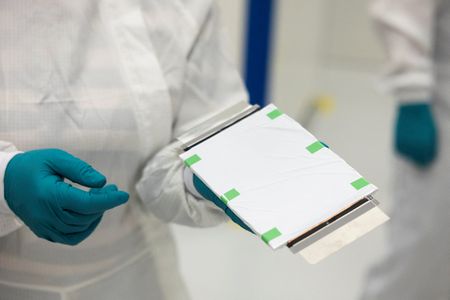

Announcements are also expected from companies ranging from Amazon to the United Arab Emirates’ MGX and Britain’s Less Common Metals Limited in the rare earth sector. Portuguese company Tekever will build a drone assembly factory in the southwest, a 100 million euro investment, the Elysee said.

Macron’s government is under pressure to stem a wave of job cuts in industry, as upheaval fuelled by U.S. President Trump’s trade policies puts further pressure on Europe’s flagging economy.

“Amid worldwide competition, France shows it has weapons, France is on the offensive to attract investments,” Lombard said, reiterating that the government should be able to meet a 2025 target for economic growth of 0.7%.

France has been the leading recipient of international investments for the past six years, according to EY’s European Investment Monitor, an annual survey of thousands of business leaders that Macron’s advisers have seized on as evidence his cocktail of supply-side reforms have been bearing fruit.

However, this year’s edition shows the number of investment projects has declined for the second consecutive year across Europe, while those in the United States rose by a fifth between 2023 and 2024, which EY said reflected the appeal of the Inflation Reduction Act subsidy package and Trump’s pro-business promises.

Despite the foreign investment flows into France, Macron has failed to stop French companies from making huge investments abroad, with Sanofi’s plan to spend at least $20 billion to boost manufacturing in the United States angering French politicians.

($1 = 0.8899 euros)

(Reporting by Dominique Vidalon; Michel Rose,Editing by Sudip Kar-Gupta, Kirsten Donovan)