By Max A. Cherney and Wen-Yee Lee

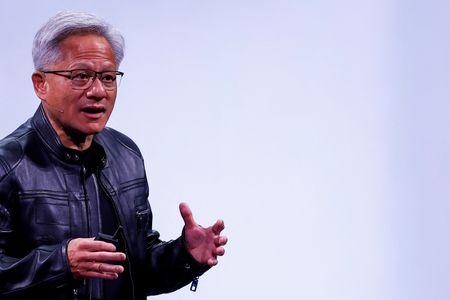

TAIPEI (Reuters) -U.S. export controls on artificial intelligence chips to China were “a failure” as they have cost American companies billions of dollars in lost sales, Nvidia Chief Executive Jensen Huang said on Wednesday.

Huang’s comments were levelled at the Biden administration’s AI diffusion rule that sought to curb exports of sophisticated AI chips by dividing the world into three tiers, with China blocked entirely. The Trump administration has said it is going to modify the rules.

“All in all, the export control was a failure,” Huang said adding, “The fundamental assumptions that led to the AI diffusion rule in the beginning, in the first place, have been proven to be fundamentally flawed.”

The U.S. block on sales of advanced AI chips to China has forced companies there to buy semiconductors from Chinese designers such as Huawei, while also spurring China to invest aggressively to develop a supply chain that doesn’t rely on manufacturers outside the country.

The Nvidia chief executive said that despite the U.S. controls, research continues, which requires vast sums of capital to acquire the necessary AI infrastructure.

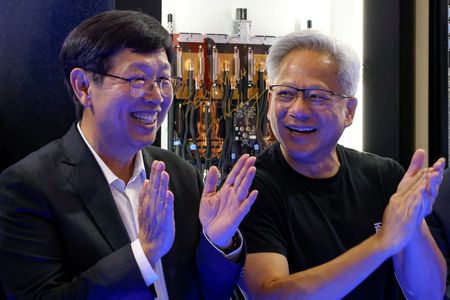

At a press conference at the annual Computex event in Taipei, Huang praised Trump’s approach to AI and said by reversing the prior restrictions, the president demonstrated he understands U.S. companies are not the only providers of such technology.

“President Trump realises it’s exactly the wrong goal,” he said in reference to the prior rules.

From the start of U.S. President Joe Biden’s administration, Nvidia’s China market share has dropped to 50% from 95%, Huang said.

Trump administration officials are weighing discarding the tiered approach to chip export curbs and replacing it with a global licensing regime with government-to-government agreements, which could give the U.S. clout in trade talks.

‘INTENSE’ COMPETITION IN CHINA

More than half the world’s AI researchers are based in China and because of the U.S. export controls on AI chips those experts have been forced to turn to local Chinese technology, Huang said.

“Our competition in China is really intense,” Huang said. “They would love for us never to go back to China.”

Huang estimated the entire AI market in China would be worth roughly $50 billion next year, which represented a significant opportunity for the company.

At the Computex event, Nvidia announced several new technologies and businesses that will expand its $130.5 billion revenue.

The company said in April it would take $5.5 billion in charges after the Trump administration limited exports of its H20 artificial intelligence chip to China, a key market for one of its most popular chips.

Earlier this week, Huang estimated that the H20-related revenue damage would amount to roughly $15 billion.

But Nvidia is working on a version of its current-generation Blackwell AI chip that will include a less speedy form of memory to comply with restrictions on the typical advanced memory included on AI chips, according to two sources familiar with the matter.

In 2022, the Biden administration effectively banned exports of advanced microchips and equipment to produce advanced chips by Chinese chipmakers, part of an effort to hobble China’s semiconductor industry and in turn the military. After those controls were implemented, Nvidia began designing chips such as H20 that would come as close as possible to U.S. limits.

China on Monday urged the United States to “immediately correct its wrongdoings” and stop “discriminatory” measures following U.S. guidance warning companies not to use advanced computer chips from China, including Huawei’s Ascend AI chips.

The U.S. action seriously undermined consensus reached at the high-level bilateral trade talks in Geneva, a statement from China’s commerce ministry said, vowing resolute measures if the U.S. continues to “substantially” harm China’s interests.

(Reporting By Max Cherney and Wen-Yee Lee in Taipei; Editing by Anne Marie Roantree, Tom Hogue and Sonali Paul)