By Caroline Valetkevitch

NEW YORK (Reuters) – Thirty-year U.S. bond yields reached their highest level in 19 months before easing on Thursday, with worries lingering over the U.S. fiscal outlook and demand for government debt, while stocks on Wall Street ended flat to slightly higher.

The U.S. dollar strengthened after recent losses.

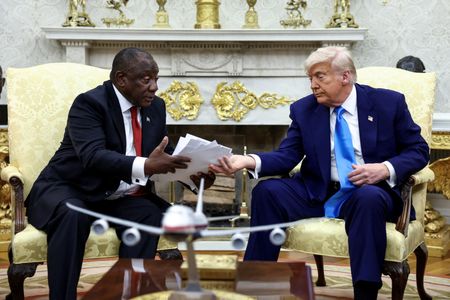

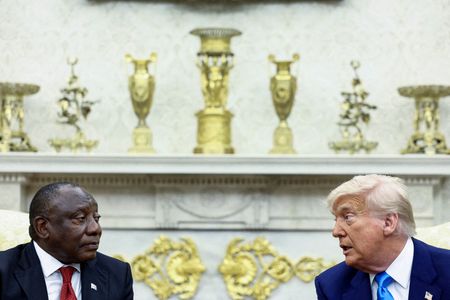

Yields rose earlier after the U.S. House of Representatives passed President Donald Trump’s tax bill by a single vote, adding to worries about the country’s debt load.

Moody’s late last week became the last of the major credit rating agencies to strip the U.S. of its coveted triple-A status.

The recent selloff sent bond prices lower, which attracted some buyers. Yields, which move inversely to prices, dipped.

The 30-year bond yield was down 3.7 basis points at 5.0521% late Thursday. The yield on benchmark U.S. 10-year notes was down to 4.551%. During the session it had reached 4.629%, the highest since February 12.

The Nasdaq ended higher, while the S&P 500 and Dow finished flat, following sharp declines in the previous session. Shares of Nvidia were up 0.8%, while Alphabet climbed 1.4%.

“Tech is the market’s security blanket at this point,” said Jake Dollarhide, chief executive of Longbow Asset Management in Tulsa, Oklahoma. “It’s seen as the leader.”

The Dow Jones Industrial Average fell 1.35 points to 41,859.09, the S&P 500 fell 2.60 points, or 0.04%, to 5,842.01 and the Nasdaq Composite rose 53.09 points, or 0.28%, to 18,925.74.

Shares of solar energy companies fell as Trump’s tax bill is expected to end a number of green-energy subsidies. First Solar shares ended down 4.3%.

The bill would deliver new tax breaks on tips and car loans and boost spending on the military and border enforcement. The Congressional Budget Office estimates Trump’s tax-cut bill will add $3.8 trillion to the $36.2 trillion in U.S. debt over the next decade.

Soft demand for a $16 billion sale of 20-year bonds on Wednesday increased concerns about reduced interest in U.S. debt.

Benchmark 10-year yields and 30-year yields have both risen by around 50 basis points this month.

“The Treasury market is looking for a circuit breaker,” said Ed Al-Hussainy, senior rates analyst at Columbia Threadneedle Investments. Among other things, “this can come in the form of poor labor market data to bring forward (Federal Reserve) cuts and trigger a reassessment of the strength of the economy.”

Also on Thursday, German long-term bond yields hit a two-month high.

MSCI’s gauge of stocks across the globe fell 2.94 points, or 0.34%, to 871.01. The pan-European STOXX 600 index fell 0.64%.

Data showed Britain’s government borrowed more than expected in April, euro zone business activity unexpectedly slipped back into contraction territory.

The euro stumbled after the data, while the U.S. dollar rose after three days of losses. The euro was last down 0.41% at $1.1283. Against the Japanese yen, the dollar strengthened 0.29% to 144.08.

Bitcoin, meanwhile, rose again to an all-time high, partly as investors sought out alternatives to U.S. assets. Bitcoin was last up 3.25% at $111,795.31.

A report that OPEC+ is discussing a production increase for July weighed on oil prices.

Brent futures fell 47 cents, or 0.72%, to settle at $64.44 a barrel. U.S. West Texas Intermediate crude eased 37 cents, or 0.6%, to settle at $61.20.

Spot gold fell 0.57% to $3,295.06 an ounce.

(Reporting by Caroline Valetkevitch in New York; additional reporting by Saeed Azhar in New York and Marc Jones in London, graphic by Naomi Rovnick; Editing by Jane Merriman, Susan Fenton, Deepa Babington and David Gregorio)