By Sanchayaita Roy, Sukriti Gupta and Shashwat Chauhan

(Reuters) -European shares ended slightly lower on Monday, with tariff-sensitive auto stocks down after U.S. President Donald Trump’s latest threat to impose steep tariffs on the European Union, though gains in financials and healthcare kept losses in check.

The pan-European STOXX 600 index closed 0.1% lower. Most regional indexes also declined, except for the UK’s FTSE 100, which rose 0.6% to an all-time high.

A big boost for the FTSE was AstraZeneca, which gained 2% after the drugmaker said its experimental drug baxdrostat significantly lowered blood pressure in a late-stage trial of patients with treatment-resistant hypertension.

Stand-out decliners in Europe were autos, with Germany’s BMW, Volkswagen and Mercedes-Benz all down around 2% each on the growing tariff worries.

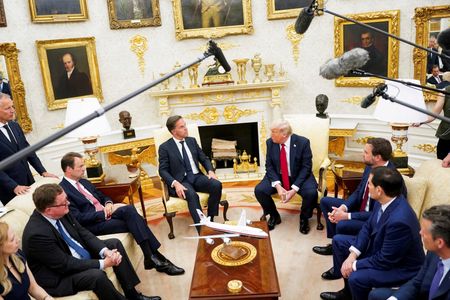

The European Union accused Washington of resisting efforts to agree a trade deal and warned of countermeasures if no deal was struck to avoid the “absolutely unacceptable” tariffs President Donald Trump has threatened to impose from August 1.

Trump stepped up his trade war on Saturday, saying he would impose a 30% tariff on most imports from the EU next month.

“Even if 30% tariffs did take effect, we doubt it would be the last word on the subject, so the market and economic reaction will likely depend on how long a full 30% tariff would be expected to last,” said Simon Wells, chief European economist at HSBC.

Shares of U.S.-exposed spirits makers Pernod Ricard and Remy Cointreau fell 1.2% and 3.4%, respectively.

Helping limit broader losses, euro zone banks climbed 0.5%, with Italian lenders Banco BPM, BPER Banca and Banca Popolare di Sondrio (BPSO) jumping in the range of 5% to 6%.

Germany’s Renk gained 4.3% after brokerage Kepler Cheuvreux raised its rating on the defence contractor to “buy” from “hold”.

At the bottom of the STOXX stood Sweden’s Lifco, slumping 9.3% after the consumer goods conglomerate missed second-quarter pre-tax profit estimates.

Looking ahead, European earnings season will kick off this week, with world’s biggest supplier of computer chip-making equipment ASML set to report on Wednesday.

In the U.S., top banks including JPMorgan Chase & Co, Goldman Sachs and Morgan Stanley are scheduled to report quarterly earnings throughout the week.

Monthly consumer prices data out of the U.S., UK and the broader euro zone are also due later in the week.

European bond markets saw losses on Monday with the yield on the German 30-year note hitting its highest since October 2023.

(Reporting by Sanchayaita Roy, Sukriti Gupta and Shashwat Chauhan in Bengaluru; Editing by Mrigank Dhaniwala, Tasim Zahid and Tomasz Janowski)