By Francesco Canepa and Jesús Aguado

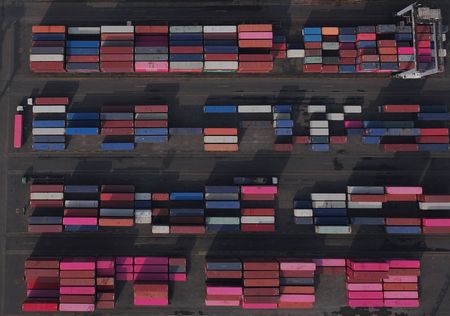

FRANKFURT/MADRID (Reuters) -European Central Bank supervisors are focusing on issues ranging from tariffs to cyber attacks and a possible dollar shortage as they assess potential risks to the region’s banking industry, five senior central bank officials told Reuters.

The ECB is looking into these risks amidst a global trade war and conflicts, such as the war in Ukraine.

Chief ECB supervisor Claudia Buch said on Tuesday the central bank would test banks’ resilience to geopolitical risk next year, telling them to come up with scenarios that had the potential to wipe out large chunks of their capital.

In addition to this, ECB supervisors have been incorporating these risks into their regular checks for months, the sources, who asked to remain anonymous as details of the ECB’s supervisory work are confidential, said.

Banks have been told to watch their exposure to other countries, both via operations abroad and through credit to exporters, supervisors have told Reuters.

Cyber attacks are also seen as a risk, particularly in Baltic countries, which have previously been the targets of Russian hackers, the sources said.

The ECB has also told banks to prepare for a global dollar drought, for example if the Federal Reserve withdraws its lifelines, as Reuters reported earlier this year

Supervisors are not telling banks to cut their exposures and they are not making specific recommendations at this stage, but rather urging banks to tighten their controls and think about contingency plans.

The checks are taking place as part of the ECB’s annual Supervisory Review and Evaluation Process and banks’ own estimate of their liquidity needs, known in regulatory jargon as the Internal Liquidity Adequacy Assessment Process.

An ECB spokesperson declined to comment.

(Reporting by Francesco Canepa and Jesus Aguado; Editing by Sharon Singleton)