FRANKFURT (Reuters) -The European Central Bank will test banks’ resilience to geopolitical risk next year, telling them to come up with scenarios that would wipe out large chunks of their capital, chief ECB supervisor Claudia Buch said on Tuesday.

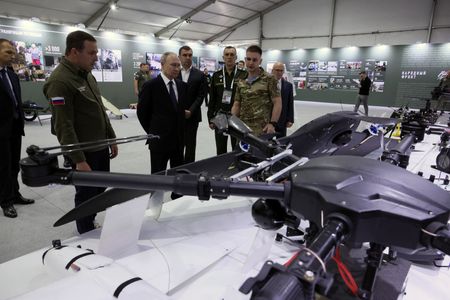

The ECB has long warned that geopolitics is one of the biggest risks for euro zone banks amid conflicts in Ukraine and Gaza, as well as the trade war stoked by U.S. President Donald Trump.

It will now assess banks’ preparedness to that type of risk, but with a twist: in typical stress tests, banks are given scenarios and must calculate how much capital would be wiped out under each.

In this exercise, however, the ECB will hand out levels of capital depletion and tell banks to come up with scenarios that could cause them.

“In the 2026 thematic stress test exercise, we will follow up on this year’s stress test by asking banks to assess which firm-specific geopolitical risk scenarios could severely impact their solvency,” Buch told the European Parliament.

Supervisors have been telling banks for months to prepare for politically motivated disruption, including a global dollar drought if the Federal Reserve withdraws its lifelines.

Next year’s exercise will be part of banks’ self-evaluation of their capital needs, known in regulatory jargon as the Internal Capital Adequacy Assessment Process (ICAAP).

The ECB runs thematic health checks on euro zone banks every other year, that is when there is no European Union-wide stress test by the European Banking Authority.

Its latest, in 2024, was about cyber-resilience.

The results of the EBA’s latest stress test, which includes some U.S. tariffs in its adverse scenario, will be announced in early August.

(Reporting By Francesco Canepa; Editing by Kirsten Donovan)