By Sinéad Carew and Alun John

NEW YORK/LONDON (Reuters) -MSCI’s global equities index lost ground on Tuesday after touching a record high, while U.S. Treasury yields hit their highest level in more than a month, as investors digested a slight rise in U.S. inflation and took a mixed view of quarterly results from big banks.

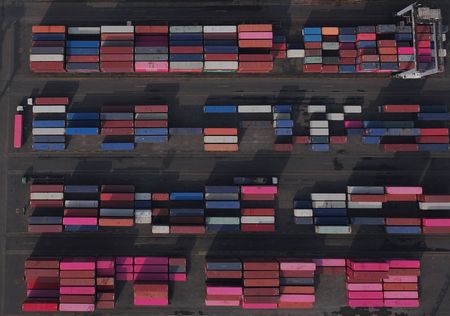

The latest economic data showed that U.S. consumer prices increased 0.3% in June, in line with forecasts, but the largest gain since January. Prices rose across goods from coffee to audio equipment to home furnishings in what economists saw as evidence the Trump administration’s increasing import taxes are being passed through to consumers.

The U.S. Federal Reserve has been keeping interest rates steady as it waited for data indicating the impact from tariffs. But after Tuesday’s data, traders stuck to their bets that the Fed is more likely than not to cut rates in September, continuing to price around a 60% chance of a move after the data.

“You do see tariffs starting to leak into the data. The question is, does it leak even more so in the future and cause inflation to rise,” and keep the Fed on hold with rate cuts, said Brent Schutte, chief investment officer of Northwestern Mutual Wealth Management Company.

And with the potential for the Trump administration to raise tariffs further in the coming months, the worry is that inflation rises further, according to Schutte. “The more that we layer on, potentially the more impact it has overall,” he said.

Investors will be carefully monitoring producer price data due on Wednesday, and retail sales data due to be released on Thursday, for signs of an impact from tariffs, according to Schutte.

On Tuesday afternoon, however, Boston Federal Reserve President Susan Collins said she is in no rush to change the U.S. central bank’s benchmark interest rate amid economic uncertainty, as data suggest that while import tariffs will drive up inflation, it is possible the overall impact may not be as bad as once feared.

On Wall Street the Dow Jones Industrial Average fell 436.36 points, or 0.98%, to 44,023.29, the S&P 500 fell 24.80 points, or 0.40%, to 6,243.76 and the Nasdaq Composite rose 37.47 points, or 0.18%, to 20,677.80.

Tech-heavy Nasdaq was boosted by chip stocks including heavyweight Nvidia which rallied 4% on Tuesday after the AI chip leader said it will resume sales of its H20 chips to China.

But MSCI’s gauge of stocks across the globe fell 3.21 points, or 0.35%, to 920.25. In Europe, the STOXX 600 index closed down 0.37%.

Also on Tuesday, investors processed the second-quarter earnings season kick-off. Results from JPMorgan Chase and Citigroup beat expectations, but were met with a mixed response.

JPMorgan ended down 0.74%, while Citi shares rallied 3.7%. Wells Fargo shares ended down 5.5% as it cut its 2025 net interest income guidance even as it beat second-quarter profit expectations.

S&P 500 profits are expected to rise 5.8% year-over-year, according to LSEG data. The outlook has dimmed since the early April forecast of 10.2% growth, before President Donald Trump launched his trade war.

TRADE WAR STILL IN FOCUS

U.S. Treasury yields rose after initially slipping following the inflation data, with 30-year yields edging above 5% and hitting their highest level since May 29.

The yield on benchmark U.S. 10-year notes rose 6 basis points to 4.487%, from 4.427% late on Monday. The benchmark yield had hit its highest level since June 11.

The 30-year bond yield rose 4.3 basis points to 5.0156%. And the 2-year note yield, which typically moves in step with interest rate expectations for the Federal Reserve, rose 5.6 basis points to 3.955%, from 3.898% late on Monday.

Trade was also still a major focus after Trump threatened over the weekend to impose 30% duties on the European Union and Mexico from August 1 – above the 20% on the EU he had initially proposed in April. However, Trump said on Monday he was open to further negotiations.

Along with tariffs and inflation, investors were focused on the U.S. fiscal and debt outlook as well as the pressure from Trump on Fed Chair Jerome Powell to cut rates, according to Steve Englander, head of global G10 FX research and North America macro strategy at Standard Chartered Bank’s New York branch.

“There are a lot of balls in the air. It’s just that it’s unclear how heavy each one of them is, and which one is going to have the biggest impact when it lands,” Englander said.

Meanwhile in currencies, the dollar reached a 15-week high against the Japanese yen, strengthening 0.78% to 148.85 yen.

The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, rose 0.52% to 98.63.

The euro was down 0.52% at $1.1602 while sterling weakened 0.34% to $1.3379.

Bitcoin fell 3.05% to $116,556.37 after hitting a record in Monday’s session. The cryptocurrency was already lower when the fate of long-awaited legislation in the U.S. Congress was cast into doubt as a procedural vote to consider the measures, aimed at providing clarity to the digital asset industry, was shot down by lawmakers from both parties.

Oil prices were lower on Tuesday after Trump’s 50-day deadline for Russia to end the war in Ukraine and avoid sanctions eased concerns about any immediate supply disruptions.

U.S. crude settled down 0.69% or 46 cents at $66.52 a barrel while Brent settled at $68.71 per barrel, down 0.72% or 50 cents on the day.

Gold prices inched lower on Tuesday as market participants awaited tariff updates, while the inflation report showed a widely expected increase in U.S. consumer prices in June.

Spot gold fell 0.46% to $3,328.07 an ounce. U.S. gold futures fell 0.64% to $3,330.10 an ounce.

(Reporting by Sinéad Carew, Chuck Mikolajczak, Karen Brettell in New York, Alun John and Lawrence White in London and Rocky Swift in Tokyo. Editing by Matthew Lewis and Stephen Coates)