By Maria Martinez

BERLIN (Reuters) -German investor morale rose more than expected in July, the ZEW economic research institute said on Tuesday, but economists warned that optimism would vanish if the EU does not reach a trade deal with the United States.

The economic sentiment index rose to 52.7 points from 47.5 points in June, while analysts polled by Reuters had on average expected a reading of 50.3.

“After the strong improvements of the past two months, the positive sentiment among respondents is becoming more firmly established,” said ZEW President Achim Wambach.

The survey’s assessment of the current economic situation also rose significantly, with the indicator rising to minus 59.5 points from minus 72 points.

Thomas Gitzel, chief economist at VP Bank, said economic confidence was boosted by the German government’s recently announced tax relief and spending packages, with the European Central Bank’s interest rate cuts also supporting consumer confidence.

Despite the recent upheaval in global trade policy, nearly two-thirds of the experts polled expected Europe’s biggest economy to improve, Wambach said.

Hopes for a quick resolution to the U.S.-EU tariff dispute, along with potential economic stimulus from the German government’s planned immediate investment programme, appear to be shaping overall sentiment, according to Wambach.

The German parliament last week approved a 46 billion euro ($54 billion) tax relief package to support companies and revive the sluggish economy from this year through 2029.

It also approved plans in March for a massive spending surge, creating a 500 billion euro infrastructure fund and ringfencing most defence investment from the rules that otherwise cap borrowing.

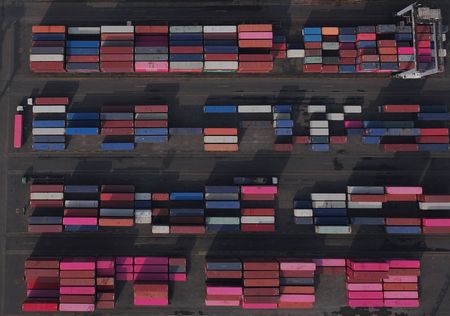

The threat of tariffs made economists more cautious about the outlook, however.

“We are not so upbeat,” said Melanie Debono, senior Europe economist at Pantheon Macroeconomics, saying she expects GDP growth slowed sharply in the second quarter, after front loading of exports to beat tariffs in the first quarter.

“Now, higher tariffs will mean net trade becomes a drag on growth and trade uncertainty will likely continue to weigh on investment,” Debono said.

Some 200 analysts and institutional investors took part in ZEW’s survey, which was conducted between July 7 and 14.

That meant the majority of the survey responses likely came in before U.S. President Donald Trump threatened a 30% tariff on EU imports to the United States.

“If the U.S. follows through with the new higher tariff, investor sentiment will likely retreat next month,” Debono said.

($1 = 0.8557 euros)

(Reporting by Maria Martinez, Writing by Miranda Murray, additional reporting by Reinhard Becker, editing by Kirsti Knolle, Hugh Lawson and Susan Fenton)