By Stephen Culp

NEW YORK (Reuters) -The S&P 500 and the Dow followed their global counterparts higher on Thursday, and Treasury yields reversed their three-day slide after a trade deal between the United States and Japan provided a welcome sign of progress in President Donald Trump’s multi-front tariff negotiations.

The tech-heavy Nasdaq was held back by weakness in tech and communication services shares ahead of hotly anticipated quarterly reports from Alphabet and Tesla expected after the bell, but an overall risk-on sentiment pulled gold away from a five-week high.

“The tech sector is suffering from high expectations,” said Paul Nolte, senior wealth advisor & market strategist at Murphy & Sylvest in Elmhurst, Illinois. “I think we’re starting to see a rotation to unloved sections of the market. It’s a recognition that the Magnificent 7 are overvalued and have very high expectations built in.”

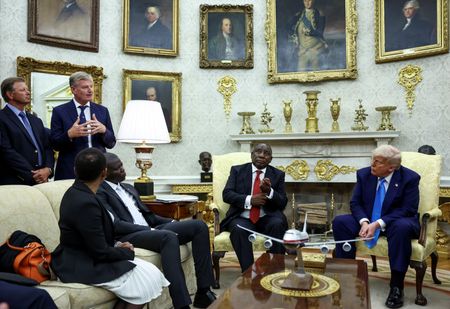

Trump reached a trade agreement with Japan, with just over a week remaining before an August 1 deadline. The deal spares Tokyo bruising new levies on autos and other goods in exchange for a $500 billion package of investment and loans bound for the United States, and stands as the most significant trade deal yet to emerge since Trump’s market-rattling “liberation day” tariff announcement.

The agreement follows a deal with the Philippines in which the U.S. will collect a 19% tariff rate on imports from there, and raises hopes that more deals could be in the offing, even as the European Commission prepares a counteroffensive, implementing tariffs on $109 billion in U.S. goods as its trade chief prepares to hold talks with U.S. Commerce Secretary Howard Lutnick.

“(Trade) negotiations are definitely ongoing and we’re probably going to see some deadlines missed and pushed out. More deals have been announced but they’re relatively minor,” Nolte added. “The elephant in the room is China. Investors are looking at these talks and saying ‘wake me up when it’s over.’ And it’s never going to be over because Trump’s been emboldened by the tariffs.”

Second-quarter earnings season is underway, with 23% of the companies in the S&P 500 having reported. Of those, 85% have beaten Wall Street expectations, according to LSEG data.

Analysts currently predict year-on-year S&P 500 earnings growth, on aggregate, of 7.5%, marking a solid improvement over the 5.8% growth estimates as of July 1.

High profile results from Magnificent 7 members Alphabet and Tesla will be closely scrutinized by investors, particularly any forward guidance that might shed light on expenditures and payoffs surrounding Artificial Intelligence (AI).

As major tech and tech-related megacaps post results, Wall Street’s reliance on a small number of momentum stocks will be put to the test.

The Dow Jones Industrial Average rose 205.18 points, or 0.46%, to 44,707.39, the S&P 500 rose 15.74 points, or 0.25%, to 6,325.15 and the Nasdaq Composite rose 6.65 points, or 0.03%, to 20,899.33.

The U.S.-Japan trade deal lifted European shares, fueling hopes for a trade agreement and negating the need for retaliatory countermeasures.

The pan-European STOXX 600 index rose 1.01%, while Europe’s broad FTSEurofirst 300 index rose 21.68 points, or 1.01%.

MSCI’s gauge of stocks across the globe rose 6.08 points, or 0.65%, to 935.86.

Emerging market stocks rose 17.45 points, or 1.40%, to 1,265.50. MSCI’s broadest index of Asia-Pacific shares outside Japan closed up 1.45% at 666.21, while Japan’s Nikkei rose 1,396.40 points, or 3.51%, to 41,171.32.

The yield on benchmark U.S. 10-year Treasury notes rose 3.8 basis points to 4.374%, from 4.336% late on Tuesday.

The 30-year bond yield rose 4.3 basis points to 4.9461% from 4.903% late on Tuesday.

The 2-year note yield, which typically moves in step with interest rate expectations for the Federal Reserve, rose 2.1 basis points to 3.853%, from 3.831% late on Tuesday.

The dollar inched higher as the yen wobbled in the aftermath of the trade deal and on speculation about the future of Japanese Prime Minister Shigeru Ishiba, who denied reports that he planned to announce his resignation.

The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, rose 0.05% to 97.51, with the euro down 0.24% at $1.1725.

Against the Japanese yen, the dollar weakened 0.08% to 146.52.

In cryptocurrencies, bitcoin fell 1.51% to $117,977.54. Ethereum declined 2.38% to $3,619.32.

Oil prices dropped as trade uncertainties ebbed.

U.S. crude fell 0.51% to $64.97 a barrel and Brent fell to $68.23 per barrel, down 0.52% on the day.

Gold prices retreated with a firmer dollar and higher benchmark Treasury yields also adding downward pressure on the safe haven metal.

Spot gold fell 0.56% to $3,411.85 an ounce. U.S. gold futures fell 0.21% to $3,432.10 an ounce.

(Reporting by Stephen Culp; Additional reporting by Tom Wilson in London; Editing by Kirsten Donovan)