By Stephen Nellis and Akash Sriram

(Reuters) -Qualcomm’s reliance on high-end smartphone chip sales and the looming loss of Apple as a modem customer overshadowed the company’s optimistic quarterly forecast on Wednesday, driving shares down more than 6%.

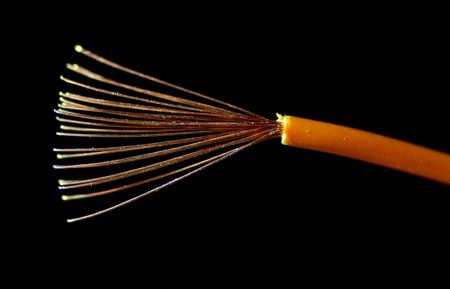

The San Diego-based company is the world’s largest supplier of modem chips that enable smartphones to connect to wireless data networks.

Qualcomm reported its chip segment revenue from non-Apple customers has risen more than 15% so far this fiscal year.

Its chip segment sales increase, excluding Apple, “is largely driven by ASP (average selling price) uplift from flagship Android launches rather than broad-based volume recovery,” said William McGonigle, analyst at Third Bridge.

Taiwan’s MediaTek has surpassed Qualcomm this year to become the global leader in smartphone chipset market share, driven by its dominance in affordable and mid-range segments and strong growth in major markets like India, according to Counterpoint Research.

Qualcomm reiterated its warning that Apple’s shift to its own modem chips in future devices will hit its chip segment revenue. The iPhone 16e, launched earlier this year, was the first Apple smartphone to house a modem developed in-house.

Qualcomm forecast September quarter revenue of $10.3 billion to $11.1 billion, compared with analysts’ estimates of $10.64 billion, according to LSEG data.

The company has not seen signs of customers ordering chips ahead of normal seasonal schedules to try to get ahead of possible tariffs, Chief Financial Officer Akash Palkhiwala told Reuters in an interview.

U.S. President Donald Trump’s tariff policies have so far provided exemptions for smartphones and semiconductor chips from these levies. But Trump has issued warnings about potential sector-specific tariffs targeting the industry, saying this month that he would “soon announce tariffs on semiconductors.”

The tariff situation remains highly fluid and complex, with existing Chinese electronics tariffs still in effect despite the exemptions granted for certain categories.

Global smartphone shipments climbed 1% in the second quarter, according to research firm IDC, as Apple, a key Qualcomm customer, accelerated shipments to avoid potential tariff impacts.

Qualcomm CEO Cristiano Amon said he expects the company’s business to supply chips to augmented-reality glasses such as Meta Ray-Bans to expand.

“We have all the designs that matter right now – the number of designs like the Meta glasses is now up to 19, and that continues to accelerate,” Amon told Reuters.

Qualcomm forecast fiscal fourth-quarter chip segment sales at a midpoint of $9.3 billion, compared with analyst estimates of $9.19 billion, according to Visible Alpha data.

The chipmaker reported sales of $10.37 billion for its third quarter ended June 29, beating estimates of $10.35 billion.

The company’s third-quarter adjusted profit of $2.77 per share topped Wall Street estimates by 6 cents.

Qualcomm expects adjusted profit in the fiscal fourth quarter of about $2.85 per share, above estimates of $2.83 per share.

(Reporting by Akash Sriram and Arsheeya Bajwa in Bengaluru, Stephen Nellis in San Francisco; Editing by Leroy Leo and Bill Berkrot)