By Jacob Gronholt-Pedersen and Maggie Fick

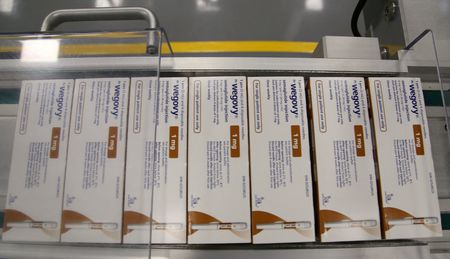

COPENHAGEN (Reuters) -Novo Nordisk expects continued competition from copycat versions of its blockbuster Wegovy obesity drug this year and could face layoffs as it battles rising pressure from main U.S. rival Eli Lilly, the Danish drugmaker warned on Wednesday.

Novo, which became Europe’s most valuable company worth $650 billion last year on booming sales of Wegovy, is facing a pivotal moment as the medicine loses market share and sees sales growth slow, especially in the United States.

It has warned of far slower growth this year – in part due to compounders who have been allowed to make copycat medicines based on the same ingredients as Wegovy due to shortages. Novo cut its full-year sales and profit forecasts last week, wiping $95 billion off its market value since.

The shares were down 3.4% at 1350 GMT.

The slide is a huge and abrupt turnaround for the firm that has been one of the world’s hottest investment stories, which led to a rapid expansion of manufacturing and sales capacity. Now the firm is eyeing potential cost-cutting measures.

“We probably won’t be able to avoid layoffs,” outgoing CEO Lars Fruergaard Jorgensen told Danish broadcaster DR. “When you have to adjust a company, there are some areas where you have to have fewer people, some (areas) where you have to be smaller.”

He added, though, that any decision on layoffs would be in the hands of the incoming CEO, company veteran Maziar Mike Doustdar, who takes over on Thursday.

On a media call, Jorgensen said the market for copycat versions of Wegovy’s class of drugs – known as GLP-1 receptor agonists – was of “equal size to our business” and compounded versions of Wegovy were sold at a “much lower price point”.

In May, the company said it expected many of the roughly one million U.S. patients using compounded GLP-1 drugs to switch to branded treatments after a U.S. Food and Drug Administration ban on compounded copies of Wegovy took effect on May 22, and it expected compounding to wind down in the third quarter.

However, finance chief Karsten Munk Knudsen said on Wednesday that more than one million U.S. patients were still using compounded GLP-1s and that Novo’s lowered outlook has “not assumed a reduction in compounding” this year.

“The obesity market is volatile,” Knudsen told analysts when asked under what circumstances the company could see negative growth in the last six months of the year. The low end of Novo’s new full-year guidance range would be for “unforeseen events”, such as stronger pricing pressure in the U.S. than forecast, he said.

The lower end of the range would imply sales around 150 billion Danish crowns ($23 billion) in the second half of 2025, compared with 157 billion in the same period last year.

ENCOURAGING PRESCRIPTION DATA

Knudsen reiterated that the company was pursuing multiple strategies, including lawsuits against compounding pharmacies, to halt unlawful mass compounding.

Jorgensen said the company was encouraged by the latest U.S. prescription data for Wegovy. While the drug was overtaken earlier this year by rival Lilly’s Zepbound in terms of U.S. prescriptions, that lead has narrowed in the past month.

Second-quarter sales of Wegovy rose by 36% in the U.S. and more than quadrupled in markets outside the U.S. compared to a year ago, Novo said.

While Wegovy’s U.S. pricing held steady in the quarter, the company expected deeper erosion in the key U.S. market in the second half, due to a greater portion of sales expected from the direct-to-consumer or cash-pay channel, as well as higher rebates and discounts to insurers, Knudsen said.

He said Novo was expanding its U.S. direct-to-consumer platform, NovoCare, launched in March, and may need to pursue similar “cash sales” directly to patients, outside of insurance channels, in some markets outside the United States.

COST CUTS

The company reiterated its full-year earnings expectations on Wednesday after last week’s profit warning.

Jorgensen said Novo was acting to “ensure efficiencies in our cost base” as the company announced it would terminate eight R&D projects.

“There seems to be a larger R&D clean-out than usual, but we do not know if this reflects a strategic re-assessment or just a coincidence,” Jefferies analysts said in a note.

Investors have questioned whether Novo can stay competitive in the booming weight-loss drug market. Several equity analysts have cut their price targets and recommendation on the stock since last week.

Shares in Novo plunged 30% last week – their worst weekly performance in over two decades.

Sales rose 18% in the second quarter to 76.86 billion Danish crowns, below analysts’ initial expectations.

($1 = 6.4198 Danish crowns)

(Reporting by Jacob Gronholt-Pedersen and Maggie Fick. Editing by Adam Jourdan, Bernadette Baum and Mark Potter)