By Yamini Kalia

(Reuters) -Online trading platform Plus500’s lack of an annual forecast upgrade and weak half-year profit margins weighed on its shares on Monday, sending them down over 6%.

The company, which has been heavily investing in expanding via acquisitions and regulatory approvals across high-growth markets, expects its full-year results to match market expectations.

“The shares have performed well this year and may now pause for breath before moving on, given the lack of upgrades at this point,” Peel Hunt analyst Stuart Duncan said.

Analysts, on average, expect revenues of $746.2 million, with a core profit of $345.2 million in 2025, according to a company-compiled consensus.

The firm made revenues of $768.3 million and core profit of $342.3 million in 2024.

Plus500 shares fell as much as 6.5% to 3,200 pence on Monday. They have risen about 22% so far this year.

Retail brokers and trading platforms thrived amid recent market turbulence driven by trade tension as investors reshuffled their portfolios to take advantage of cheaper assets.

The Israel-based company’s peer IG Group reported a forecast-beating rise in full-year pre-tax profit in July.

Plus500 has been capitalizing on the global futures trading boom in countries such as India, the U.S. and the UAE, with focused attention on penetrating newer markets and client base.

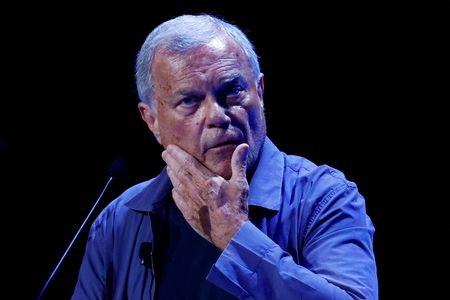

“We are focusing on higher-end countries…to target more valued customers,” said Plus500 CEO David Zruia, adding that the company is actively looking for further licensing and acquisition opportunities without naming the target regions.

Plus500’s core profit margin fell to 45% from 46% in the six months to June-end, while core profit saw a modest 1% increase to $185.1 million.

Active customer numbers stayed steady at 179,931 in the period, a 2% increase from the previous year.

The company also launched $165 million of shareholder returns on Monday.

(Reporting by Yamini Kalia and Rishab Shaju in Bengaluru; Editing by Rashmi Aich and Raju Gopalakrishnan)