By Cian Muenster and Linda Pasquini

(Reuters) -German premium beauty retailer Douglas reported a smaller than expected drop in its quarterly core profit on Thursday, boosted by higher sales and tight cost management that helped offset effects of promotions meant to bring in cost-conscious customers.

The consensus-beating results sent the company’s shares nearly 9% higher.

Adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA) fell 2.9% to 158.2 million euros ($185.1 million) in Douglas’ fiscal third quarter, above the average estimate of 143.8 million euros from analysts polled by Vara.

It said the decline was mainly due to the promotional environment, as beauty retailers discounted their products to attract customers grappling with tighter budgets amid economic uncertainty.

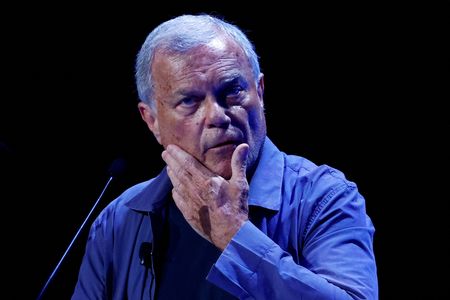

“We see that many listed companies in the premium beauty segment are reporting a slowdown in their top line,” CEO Sander van der Laan said during an investor call.

Coupled with shoppers trying to save money, “that is typically an environment where promotions are being increased,” he added, warning that discounting was likely to intensify in the second half of 2025, posing a risk to margins.

Douglas has so far managed to mitigate the pressure on margins through measures such as reducing marketing and logistics costs, with van der Laan saying it was trying to “negotiate hard” on price hikes with cosmetics companies whose products it sells.

He said that while Douglas was making an effort to push price increases onto customers to protect its margins, it was not always easy when consumers are hunting for the best deals.

The company’s net sales rose 3.2% to 1 billion euros, driven by strong performance in Central and Eastern Europe. Deutsche Bank analyst Adam Cochrane said the beat was helped by the timing of Easter, which fell in the quarter.

Douglas, which has struggled with weaker consumer demand in the first quarters of the fiscal year that will end on September 30, confirmed the annual outlook it had cut in March.

($1 = 0.8549 euros)

(Reporting by Cian Muenster and Linda Pasquini in Gdansk, editing by Milla Nissi-Prussak)