By Nell Mackenzie

LONDON (Reuters) -Shareholders of Third Point Investors Limited have voted in favour of a deal that will see the fund acquire Malibu Life Reinsurance SPC, a TPIL statement said on Thursday.

The merger with a Cayman-based reinsurer will see the London vehicle morph from a listed equity fund into an annuities specialist that will also be buying asset-backed credit and corporate debt.

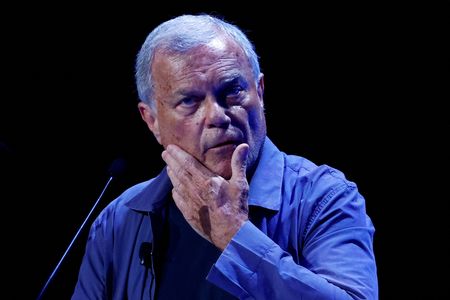

Billionaire Daniel Loeb proposed in May to transform his Third Point Investors Limited into a reinsurance fund that would invest in the fixed annuity market in the U.S.

The UK regulator’s new listing rules no longer require a majority support among independent shareholders in related-party transactions, like merging with a company that a manager or CEO also runs.

Previous rules would have excluded Loeb’s 25% share stake in TPIL from voting, giving minorities an amplified voice.

The approved transaction will swap investor shares for Malibu equity at net asset value (NAV).

The fund change is designed to address a valuation discount TPIL has to Loeb’s New York-based hedge fund Third Point.

Like other UK-listed investment companies, TPIL is known as a feeder fund and was originally designed to give retail shareholders a taste of hedge funds that had long been off limits to all but wealthy financiers.

By the end of 2027, the new reinsurance operating company expects to deliver mid-teens returns, the company said.

Last year TPIL gained 25.5% after fees. This year it has returned just over 3%.

A dissenting shareholder group said the acquisition should be put to an independent vote.

“The Group is deeply concerned by the way that today’s outcome has been reached. As these EGM results make clear, these changes have been conceived, developed, and now forced through by Third Point, the Board and VoteCo, with independent shareholders merely as passengers,” a statement from the group said.

It includes UK investment firm Asset Value Investors Limited, Metage Capital and Evelyn Partners Investment Management, as well as Australian investment firm Staude Capital and California-based Almitas Capital.

Proxy advisers Glass Lewis, backing the deal, and ISS, opposing it, were split on the shareholder vote.

(Reporting by Nell Mackenzie. Editing by Anousha Sakoui and Toby Chopra)