By Ziyi Tang, Engen Tham and Selena Li

BEIJING/SHANGHAI/HONG KONG (Reuters) -China’s Ping An Insurance plans to further invest in shares to boost its portfolio return while staying cautious about Chinese economic growth, Co-CEO Michael Guo told Reuters.

The privately owned insurer, with 6 trillion yuan ($838 billion) in investment funds, vowed to buy more stocks after allocating more money for high-dividend Hong Kong-listed banks earlier this year rather than for long-term Chinese government bonds where yields were flirting with record lows.

“The stock market been doing really well these days and now we are seeing the historical high… We are going to probably allocate a bit more towards the equity market,” Guo said prior to Ping An’s first-half earning’s briefing on Wednesday.

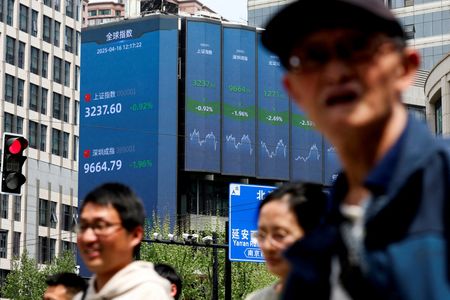

Hong Kong shares have gained 30% this year while the Shanghai composite index has risen more than 18%, touching a multi-decade high.

The insurer may look at “high-dividend, high-yield assets … growth assets like high-tech or AI-related companies”, said Guo, who joined Ping An in 2019 and became one of its two co-CEOs in 2023.

Ping An has allocated about 13% of its insurance funds to the equity market. Guo did not detail the size of any increase.

Improving performance of Chinese stocks in the first half added around 60 billion yuan in gains in a separate investment account, independent from business profit but once realised can be used to pay dividends, Ping An said during an earnings briefing.

Guo said the insurer is nevertheless cautious about the rising stock market, which he believes is largely driven by short-term liquidity.

“We still want to see the improvement of the fundamentals of the overall economy, and of the companies’ earnings capabilities,” said Guo, formerly a senior consultant with BCG.

Ping An’s Hong Kong-listed share price was down 1.04% on Wednesday after the insurer released first-half earnings late on Tuesday. It reported a nearly 9% on-year fall in net profit to 68 billion yuan, and a 30% decline in investment income to 6 billion yuan.

Earnings suffered a hit of 3.4 billion yuan from the group consolidation of Ping An Doctor, and a loss from convertible bond issuance after an increase in its share price, Guo said.

The insurer raised $1.5 billion in June via a zero-coupon convertible bond issuance which, with other convertible bonds, it books as a loss when its share price rises.

Guo also said that, as Chinese investors are “pessimistic about the overall economy in the short term”, they are seeking to invest more in conservative products such as insurance.

The earnings report showed operating profit rose 3.7%, driven by strong growth of new sales.

The new business value (NBV) in its life and health insurance segment, which measures the profitability of new policies sold, grew nearly 40% to around 22 billion yuan.

Banking unit Ping An Bank reported a 3.9% fall in net profit to 24.87 billion yuan, as sluggish loan demand weighed on performance.

Guo said the surprisingly high sales increase was partly driven by strong growth in its bancassurance channel, as volume grew 170% from a year earlier via Ping An Bank and non-affiliated distributors.

($1 = 7.1529 Chinese yuan renminbi)

(Reporting by Ziyi Tang and Engen Tham and Selena Li; Editing by Helen Popper and Christopher Cushing)