By Louise Rasmussen, Jacob Gronholt-Pedersen and Maggie Fick

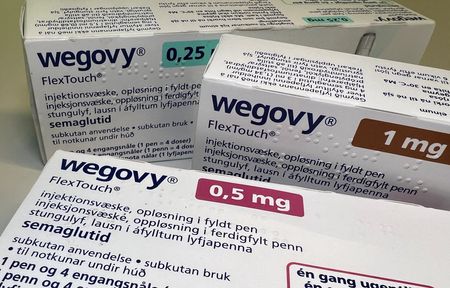

COPENHAGEN (Reuters) – Novo Nordisk, the maker of blockbuster weight-loss drug Wegovy, said on Wednesday it will cut 9,000 jobs in a bid to reignite growth and fend off intense competition from U.S. rival Eli Lilly and a wave of compounded copycat drugs.

The restructuring, expected to save 8 billion Danish crowns ($1.25 billion) annually, comes as Novo Nordisk faces slowing momentum in its once-booming obesity and diabetes franchises.

The Danish company also issued its third profit warning this year, citing 9 billion crowns in one-off costs tied to the overhaul.

Novo’s meteoric rise began in mid-2021 when Wegovy became the first highly effective obesity drug approved in the U.S., catapulting the firm to the top of Europe’s stock market.

But a hiring spree that nearly doubled its headcount over five years has now backfired. The layoffs take Novo’s headcount back to early 2024 levels, said Redburn Atlantic analyst Simon Baker.

Investors in July wiped $70 billion off the drugmaker’s market value after Novo warned on profits and named company veteran Mike Doustdar as its new CEO.

Shares have fallen nearly 46% since the start of the year, bringing its market capitalisation to around $181 billion—well below its peak of approximately $650 billion last year.

“This is the new CEO’s first major move to simplify Novo’s structure and redirect resources toward growth in diabetes and obesity, rather than just cutting costs to boost margins,” said Michael Novod, head of equity research for Denmark at Nordea Bank.

Shares in Novo Nordisk were up 3.3% at 0939 GMT, having initially fallen 3%.

Novo is slimming down while also trying to boost output to meet rising demand for its products and readying the pill version of Wegovy as well as exploring the additional health benefits of its GLP-1 portfolio.

Novo Nordisk, which employs 78,400 globally, has faced challenges as sales of Wegovy and diabetes treatment Ozempic begin to lose momentum, particularly in the United States.

Eli Lilly’s Zepbound overtook Wegovy in weekly prescriptions in the U.S. earlier this year, although Wegovy prescriptions began to increase at a faster pace over the summer, narrowing Lilly’s lead in the critical market.

CEO Mike Doustdar, who assumed leadership last month, said the overhaul would simplify operations, accelerate decision-making and redirect resources toward growth areas.

Novo shareholder Lukas Leu, a portfolio manager at ATG Healthcare, which is building a healthcare fund, said Novo’s cost-cutting measures fell short of reassuring investors.

“The obesity market was misjudged. It’s much more consumer-driven than anticipated, and Novo expanded organisational complexity too quickly,” he said.

CUTTING THE FAT

The company now expects operating profit growth for 2025 to be between 4% and 10%, down from the 19%-27% range it forecast at the beginning of the year.

“Sometimes the hardest decisions are the right ones for the future we’re building. I’m confident that this is the right thing to do for the long-term success of Novo Nordisk,” Doustdar said in a post on LinkedIn.

The company declined to specify which business units would be impacted.

The layoffs, which will affect 5,000 workers in Denmark, follow a global hiring freeze announced last month for non-essential roles. Novo Nordisk expects to save 1 billion crowns in the fourth quarter and reaffirmed its commitment to reinvesting those savings into research and development, manufacturing expansion, and improving global patient access.

Sydbank analyst Soren Lontoft Hansen described the scale of the layoffs as “surprising”.

“It just shows that the company is transitioning from a period of rapid growth and heavy hiring to a new reality of slower growth, and is now adjusting accordingly,” he said.

($1 = 6.3792 Danish crowns)

(Additional reporting by Soren Jeppesen and Stine Jacobsen; Editing by Terje Solsvik, Jamie Freed, Edwina Gibbs and Louise Heavens)