By Johann M Cherian and Tristan Veyet

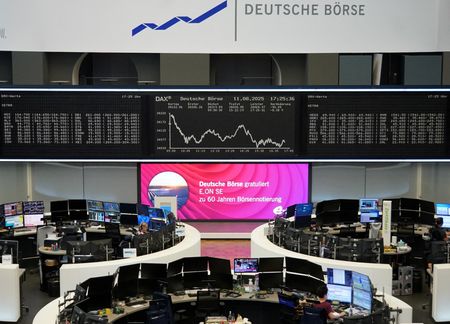

(Reuters) – European shares finished higher on Thursday as a rally in defence stocks helped lift the main index, with investors taking in a widely anticipated European Central Bank decision to keep interest rates unchanged.

The pan-European STOXX 600 ended 0.51% higher at 555.13 points, with the region’s aerospace and defence index hitting an all-time high, up 2.5%.

Defence stocks led index gains as investors weighed ongoing geopolitical tensions in the eastern part of the continent after Poland shot down a suspected Russian drone earlier in the week.

BAE Systems jumped 6.3%, Rheinmetall rose 2.3% and Rolls-Royce advanced 2.1%.

“The more we get these little touch points of continued reminders that there’s ongoing uncertainty, the more investors are simply saying I need to have these defence stocks in my portfolio,” said Daniel Coatsworth, chief investment officer at Moneyfarm.

Meanwhile, the ECB left interest rates unchanged on Thursday as expected but offered no clues about its next move, reiterating that the following decision will be data-dependent.

The central bank also lowered inflation forecasts to 1.9% in 2027, below the 2.0% projected in June, while core inflation is seen at 1.8% then, both below the 2% target.

Traders curbed their bets on another rate cut, seeing just under a 50% chance of a cut by June 2026, according to ICAP data. Declining bets supported the euro, which was last up about 0.3% against the dollar.

“The ECB appears confident that the economic bloc can withstand the impact of President Trump’s tariffs for some more time, when it decided to hold the deposit rate unchanged at 2%,” said Richard Flax, chief investment officer at Moneyfarm.

Germany’s two-year bond yield, vulnerable to interest rate expectations, was up 4 bps to 1.99%.

The construction and materials sector jumped 1.4% after JP Morgan turned positive on key European building-materials names, upgrading Italy’s Buzzi to “overweight” and keeping Germany’s Heidelberg as its top pick. Buzzi rose 6.7% and Heidelberg added 2.5%.

Leading automaker Stellantis became the top individual gainer for the day, up 9.1%. New CEO Antonio Filosa said the company is reintroducing models, including Jeep Cherokee and 8-cylinder RAM trucks.

The stock lifted the index of automakers by 1.27%.

The French benchmark index CAC 40 climbed 0.8% despite being at the receiving end of political and fiscal uncertainties. Brokerage Citigroup has downgraded the country’s equities to “neutral” from “overweight” ahead of a crucial rating review by Fitch on Friday.

Kering gained 2.4% after the Gucci owner said it will not fully buy Italian fashion brand Valentino until at least 2028, pushing back an expensive deal that has been weighing on the heavily indebted group.

Covestro rose 7.9% after Reuters reported that Abu Dhabi state oil giant ADNOC is readying remedies to address an EU subsidy investigation into its 14.7 billion euro ($17.19 billion) bid.

Stateside, investors digested hotter-than-expected U.S. consumer prices data for August, which did little to alter expectations for Federal Reserve interest rate cuts.

Technip Energies rose 4.7% after the energy infrastructure company said it had agreed to buy U.S.-based chemicals group Ecovyst’s Advanced Materials & Catalysts business for $556 million.

(Reporting by Tristan Veyet in Gdansk, Johann M Cherian in Bengaluru; Editing by Mrigank Dhaniwala, Alexandra Hudson)