By Ira Dugal

This was originally published in the India File newsletter, which is issued every Tuesday. Sign up here to get latest news from India and how it matters to the world.

With the government’s annual budget announcement out of the way, the focus for Indian investors has now shifted to the central bank. Will rate cuts need to – and be able to – do the heavy lifting to boost growth? That’s our focus this week.

Trump fires his first tariff salvo, hitting Asian currencies including the rupee. And is India having a rethink of its approach to cryptocurrencies? Scroll down for more on that.

This week in asia

** Trump pauses tariffs on Mexico and Canada, but not China

** China denounces Trump tariff: ‘Fentanyl is America’s problem’

** Asia’s factory activity weakens as Trump tariffs jolt sentiment

** SoftBank, OpenAI unveil Japan AI joint venture

** Myanmar junta extends state of emergency to support election preparations

Passing the growth baton

The Indian government’s annual budget ticked some of the right boxes for reviving growth but left many others blank. Now it’s the central bank’s turn.

Saturday’s budget announcement focused on urban middle-class consumers and their clamour for relief from the high cost of living. Prime Minister Narendra Modi’s government offered tax cuts that it hopes will boost consumption, along with some narrower policy steps such as funds for the strategic petroleum reserve and a stronger push into nuclear energy.

But analysts were disappointed at the lack of economic reforms that could propel growth back towards aspirational rates above 8%.

The measures fall some way short of constituting major stimulus, Shilan Shah, deputy chief emerging market economist at Capital Economics, said in a report.

The onus now shifts to the Reserve Bank of India. Economists polled by Reuters expect it to begin cutting interest rates for the first time in more than four years when it meets this week.

Some forms of monetary policy easing have already begun. The central bank is adding liquidity to the banking system and has eased enforcement actions against non-bank lenders, which had made the sector more risk-averse. This should help to push up bank loan growth, which has fallen for six consecutive months.

The authorities have also loosened their grip on the rupee, allowing a greater degree of depreciation which in turn acts as a stimulus to exports.

How deep can they cut?

It’s over to rate policy now, although economists doubt whether rate cuts alone could take India back to 8% growth within the next couple years.

HSBC expects two rate cuts in February and April of 25 basis points each, bringing down India’s benchmark policy rate to 6%, in a “shallow” easing cycle, Pranjul Bhandari, chief India economist at HSBC, said in a report. Market volatility and brewing global trade wars could pressure India’s balance of payments and weaken its currency, she said, preventing steeper rate cuts.

JPMorgan, however, expects 100 basis points in rate cuts in 2025, beginning this week, said Sajjid Chinoy, the bank’s head of Asia economic research, in a December report.

Economists saw little risk that the budget’s stimulus steps would stir up inflation and narrow the scope for rate reductions.

The government aims to trim the budget gap, or fiscal deficit as a percentage of GDP, to 4.4% for 2025/26 from 4.8% this year, which would not be inflationary, HSBC’s Bhandari said.

With inflation falling, “we expect the RBI to cut rates and infuse domestic liquidity, picking up the growth baton”, she said.

JPMorgan’s Chinoy added that, with food prices expected to soften early this year on the back of a strong harvest and with GDP growth expected at 6.4% in the current financial year, well below the RBI’s original estimate of 7.2%, there is room for significant rate easing.

How low should interest rates fall in India? Will the RBI rate cuts be enough to boost growth? Write to me with your views at ira.dugal@thomsonreuters.com.

Quote of the week

“More than one or two jurisdictions have changed their stance towards cryptocurrency in terms of the usage, their acceptance, where they see the importance of crypto assets.”

India’s Economic Affairs Secretary Ajay Seth told Reuters in an interview that the government is reviewing its approach to cryptocurrencies amid changes in policy globally.

Such assets “don’t believe in borders” and India’s stance cannot be unilateral, Seth said.

The Indian authorities have yet to release a discussion paper on cryptocurrency regulation originally scheduled for last September. The central bank has consistently warned against cryptocurrencies and discouraged their use.

Market matters

The Indian rupee weakened past the 87-per-dollar mark to a record low on Monday after global markets were jolted by U.S. President Donald Trump’s tariffs on Mexico, Canada and China.

The dollar soared against most of its peers, including the rupee.

The Indian central bank did not intervene heavily to slow the rupee’s decline, bolstering analysts’ view that the RBI is allowing the rupee to move in line with other currencies.

A partial rollback of the planned tariffs offered currencies some relief on Tuesday.

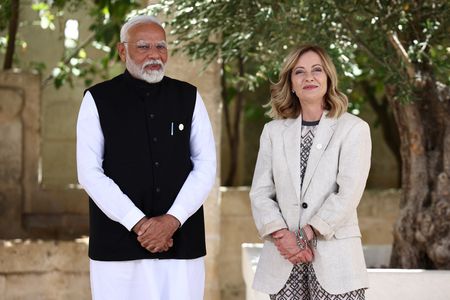

The Indian market will remain focused on Trump’s policies, as Prime Minister Narendra Modi visits Washington next week.

(By Ira Dugal; Editing by Edmund Klamann)