By Tom Sims, Francesco Canepa and John O’Donnell

FRANKFURT (Reuters) -Banks struggled to process payments on Friday after an unprecedented day-long breakdown in the European Central Bank’s machine underpinning trillions of euros of money movements.

The ECB said late on Thursday it had fixed the roughly seven-hour outage in its payment system, which had left transactions likely worth trillions of euros from firms, consumers and investors up in the air.

But the breakdown, which has dealt a blow to the international standing of the central bank behind one of the globe’s most important currencies, continued to reverberate on Friday.

“The Eurosystem (of euro zone central banks) acknowledges that the outage had adverse consequences for market participants as well as for their clients,” the ECB said in an update published late on Friday.

The malfunction of the so-called Target 2 system (T2), used to settle more than 3 trillion euros ($3.12 trillion) of daily payments and financial trades, meant transactions between banks could not go through.

Germany’s central bank, the Bundesbank, said on Friday ordinary bank payments, such as wages, pensions and social welfare transfers, have been delayed and could take several hours longer than usual to arrive.

Deutsche Boerse’s Clearstream, which processes the trading of securities such as company stock, and handles around 500,000 transactions daily, also reported delays.

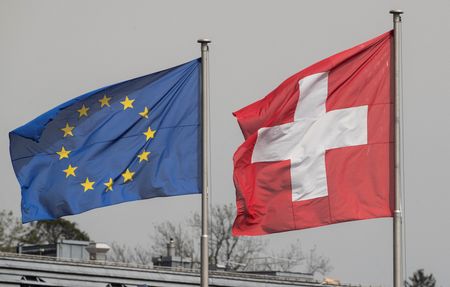

Switzerland’s SIX stock exchange said it had made up a delay in settlements on Thursday by extending the settlement day, and was able to start business as usual on Friday.

The Swiss Bankers Association said it was unaware of any impact on the country’s banks from the ECB outage.

Banks, which depend on the ECB system to settle their euro accounts with one another, had been instructed to keep placing their payments in the queue until the issue was finally fixed.

The incident lasted until early on Friday morning, delaying money sent in the night for about six hours, said a person familiar with the breakdown, and upsetting the system for what is likely to be a number of days.

While it remained unclear whether the mishap would be felt by regular bank customers, it has raised a question mark over the transactions between lenders that underpin the very functioning of the euro zone’s economy.

The ECB ruled out “malicious (or) foul play” on Thursday, blaming instead a “hardware defect”.

On Friday, the central bank for the euro zone said it initially thought the problem had been in the system’s database but later found out it was “actually due to an infrastructure component”.

“A thorough analysis of the incident has been initiated,” the ECB said on Friday. “It will identify measures to allow an earlier identification of the root cause and to avoid reoccurrence in the future.”

Rebecca Christie of Brussels-based economic think tank Bruegel said the incident was a “wake-up call”.

“This is a wake-up call that all serious digital payment and currency systems need … backups,” she said. “Outages dent … credibility.”

($1 = 0.9614 euros)

(Additional reporting by Frank Siebelt in Frankfurt and Oliver Hirt and Ariane Luthi in Zurich; Editing by Matthias Williams, Thomas Seythal, Gareth Jones, Philippa Fletcher and Susan Fenton)