By Mariko Katsumura

MYOKO, Japan (Reuters) – Three winters from now, Japan’s snowy Myoko highlands will be home to a $1.4 billion mega-resort built by a Singaporean fund, with hotels charging some $1,350 a night.

The project by Patience Capital Group (PCG) promises to create 1,000 jobs and spur winter tourism. But for many Myoko locals, foreign interest has become a double-edged sword, threatening overdevelopment, sky-high prices and the sweeping away of traditional culture.

Even before news of PCG’s interest, many inns, ski rental shops and restaurants in Akakura – one of five major ski resort towns in the Myoko region – had been snapped up by foreigners.

But they’re only interested in the snow and once that melts, those businesses shut. The town, also once a bustling hot-spring destination, no longer has enough going on to attract many visitors during the rest of the year.

“If you come to Akakura in summer, it’s pitch dark at night,” said Masafumi Nakajima, owner of local inn Furuya and head of the 200-year-old town’s hot spring-inn tourism association. He estimates only 10 of about 80 inns in Akakura operate year-round.

Located roughly 2.5 hours from Tokyo by train in Niigata prefecture, Myoko, along with the more famed Japanese ski resorts of Niseko and Hakuba, is known for powder snow, dubbed “Japow”.

The resort areas are a huge part of Japan’s tourism boom, also fuelled by a weak yen, which saw inbound tourist numbers jump 17% in February, hitting a record high for that month.

Nakajima said many foreign business owners in Akakura have refused to join the local tourism association. One consequence is a lot of broken rules on the part of businesses and tourists that range from not disposing of garbage properly, to overparking to late-night fireworks.

“We have no idea who they are and what they’re doing. They just come in December and disappear when spring comes,” he said. Nakajima recently started approaching foreign businesses to offer lectures on the town’s rules.

PRICED OUT

Many locals fear Myoko could go the way of Niseko.

The resort on the northern island of Hokkaido has become a world-renowned winter sports destination on the back of high-end foreign developments, but the surge in property prices brought higher taxes for locals choosing not to sell. Inflation there – from labour costs to a bowl of ramen – has gone through the roof, pricing locals and most domestic travellers out of the market.

Hakuba, in the Japanese Alps, has followed a similar path, while one township in Myoko has already seen land prices jump as much as 9% last year.

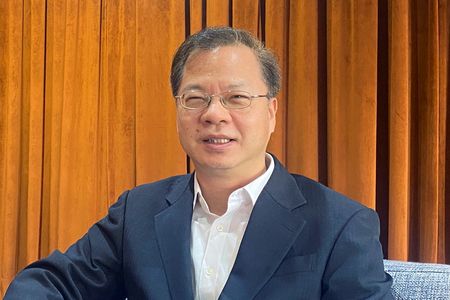

PCG’s Tokyo-born founder, Ken Chan, said he’s mindful of local fears about his project, which will span 350 hectares and two ski slopes.

To attract visitors year-round, PCG wants to promote its two planned luxury hotels for business conferences and is considering discounts during non-peak times for local residents who want to ski or snowboard, he told Reuters.

He also intends to host a meeting with residents in the coming months.

Myoko City mayor Yoji Kido said he’s cautiously optimistic about PCG’s development plans but has heard few specifics.

Kido has been fielding more enquiries from foreign investors and conscious of local concerns, the city is considering new regulations for larger projects from the 2027 fiscal year.

“It’s going to be an unusually big development for our city,” he said. “I can’t deny that things aren’t worry-free.”

Koji Miyashita, the owner of a half-century-old shop in Akakura that sells steamed buns filled with red bean paste, said he sometimes feels like he doesn’t live in Japan as Westerners throng the town’s streets.

Development in Myoko should sustain the region’s culture, he said, adding: “We don’t want to be another Niseko.”

($1 = 149.4600 yen)

(Reporting by Mariko Katsumura; Additional reporting by Tom Bateman; Editing by Chang-Ran Kim and Edwina Gibbs)