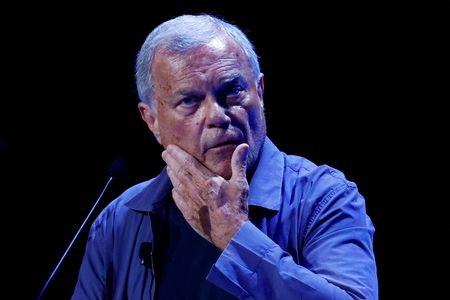

(Reuters) -Martin Sorrell’s ad group S4 Capital is in early talks to potentially combine with marketing agency MSQ Partners, it said on Monday, sending its shares as much as 14% higher.

S4 Capital, established in 2018 following Sorrell’s exit from rival WPP, said any potential transaction would see it acquire MSQ Partners, a firm majority-owned by private equity group One Equity Partners.

There is no certainty a deal will be concluded, S4 added.

S4 Capital, hit by client spending cuts due to U.S. tariffs and a shift towards AI-driven marketing, lowered its revenue forecast in June as advertising firms face rising pressure to adapt or risk losing major accounts.

The company’s shares have dropped roughly 98% from their September 2021 peak to give a market value of about 140 million pounds, a fraction of its previous worth.

The shares bounced from Friday’s record low early on Monday, and were 10% higher at 23.25 pence by 0756 GMT.

Sorrell, who built WPP into the world’s biggest advertising agency through 33 years of dealmaking, quit the ad group in April 2018, after an allegation of personal misconduct, which he denied.

The potential merger with MSQ Partners would give S4 Capital access to a broader client base spanning the finance, healthcare, and consumer goods sectors.

MSQ has more than 250 clients including Unilever, Haleon, P&G and Lego. S4’s clients include Google-parent Alphabet, Amazon and Meta.

The deal discussions were first reported by Sky News on Saturday.

(Reporting by Yamini Kalia and Raechel Thankam Job in Bengaluru; Editing by Rashmi Aich and Sherry Jacob-Phillips, Kirsten Donovan)